I attended the public hearing about “State of Energy in the Commonwealth” yesterday (04/14/2015). I learned that, if you can find the time, attending these meetings in-person is worthwhile; you pick up on subtle things beyond the slides.

This was part one of a two-part hearing (they’re targeting May 12th for the second hearing). Yesterday the testimony came from:

- Energy and Environmental Affairs Secretary (EOEEA) Beaton

- Massachusetts Clean Energy Commission (MA CEC)

- Department of Energy Resources (MassDOER) Acting Commissioner Burgess

- Department of Public Utilities (DPU) Chair O’Connor

- Independent System Operator of New England (ISO-NE)

- National Grid

- Eversource

- Unitil

- Municipal Electric Association of Massachusetts

- Attorney General’s Ratepayer Division

Pre-Meeting

Before the meeting there were many people gathered in the hallway and I had the opportunity to talk to a couple from Quincy who unfortunately are within the shadow of a land-based wind turbine. It can be frustrating to live with pulsating light. Unfortunately this made them detest all wind power (on-shore or off-shore) and they were there to fight any wind. What this highlighted for me is the importance of properly siting wind project through mechanisms like pro-active local ordinances; if done poorly we create renewable detractors.

The meeting room itself was small and packed with participants (standing room only). Although uncomfortable, the closeness was personal; I could clearly see all the legislators and people giving testimony. What surprised me is how civil the hearing was overall; many of the players appear to have working relationships and although there was not agreement there also was very little grand-standing. Questions were useful but non-confrontational; the co-chair Senator Dowling asked the bulk of the questions. The number of questions, however, was limited because they wanted to keep to the schedule. I also felt the depth and scope of the questions were very limited.

With that, let me give quick impressions I got from all the presenters. To be clear these are [admittedly biased] impressions; as opposed to some of my other posts that are structured logical arguments.

EOEEA Secretary Beaton

Secretary Beaton’s prime focus was on electricity cost and economic competitiveness. He highlighted gas constraints stating that it causes price volatility and if not handled we’ll have rolling blackouts (the latter part surprised me as no other group has gone that far on the risk factors). He supports gas pipeline expansion however he minimized opposition as siteing concerns and down-played the low electric wholesale prices we saw this winter as getting lucky with oil prices. Lastly he said that he feels the committee will be surprised with the collective message and firm commitment that will come from the Governor’s meeting next week on this topic.

Beyond this I felt cognitive dissonance; he acknowledged Massachusetts is the national leader on efficiency and that we should expand on it, however he set a goal to make efficiency more efficient and hinted that efficiency programs should be handed of to the private sector and that we may be able to reduce our costs by eliminating the efficiency charge from our electric bills (this would effectively kill programs like MassSaves). Then he stated the Baker administration has a goal to create a new website that will be a one-stop shop for efficiency (perhaps a private-sector replacement to MassSaves?)

This seemed to be a common theme; in testimony groups verbally support something then their proposed actions would effectively kill it; I’ll get more into that later.

He also acknowledged climate change with the solution being the “Global Warming Solutions Act” (I have not read up on that yet) and they support additional solar but provided no details on how.

Mass CEC

Nothing dramatic from the CEC; just that their programs have been very successful and that they’re phasing out their solar subsidy (I got the impression that solar uptake is so fast that it surpassed the subsidy).

Mass DOER

MassDOER’s presentation was much more low-key then I expected given their phenomenal success. They highlighted that Massachusetts is the national leader in efficiency (another common theme) and that MassDOER efficiency programs get 300% return on investment.

They also support additional solar electric but want to do more with solar thermal and are investing $40m in “solar resiliency”. They are also helping to re-work net-metering. This overall is interesting because solar thermal generally has a smaller return on investment now that electric panel prices have fallen; I wonder if they are getting pressured by utilities who don’t like solar electric?

Beyond that they stated they’ve had great progress in their “LEED-ing by example” program (for government buildings) and “Green Communities” program.

Lastly they acknowledged they authored Baker’s plan for gas expansion.

DPU

The DPU presentation was interesting. Chair O’Connor acknowledged the rate-payer uproar about prices but stressed the core problem was beyond the DPU’s control as they were winter issues with the energy market. To illustrate she unveiled that National Grid’s summer rate is slated to nearly drop in half to $.09/kwh.

Despite that there was a little grand-standing about electric rates.

O’Conner’s solution to the rate problem is interesting; she’s pushing hard to get everyone off of basic service and onto competitive suppliers and is planning to make a website that breaks down what suppliers are available and what their terms are. She also eliminated confusing billing rules when someone chooses to swap.

This overall makes sense to me; I see a lot of problems arise from the fact that utilities were removed from the generation business but they still sell basic service. This both confuses rate-payers as well as creates conflicts of interest at the utilities. I remember the last time the DPU tried to phase out basic service around the year 2000 I had looked into it but it was a broken plan; there was only two competitive suppliers and if you left basic service one was not allowed to return to it. It was like throwing rate-payers into the water with the sharks. With enough competitors, good information and the ability to fall-back to basic service it might just work this time.

Beyond that, she acknowledged that she is new to the position and is still learning and one of the recent things she learned is about the supply restrictions that a gas company is western Massachusetts is experiencing and the fact they have done everything they can possibly do to alleviate the problems and as such are forced to implement new customer moratoriums (I believe she was referring to Berkshire Gas). She expounded on the problems this is causing for residents in Western Massachusetts. Based on her testimony, I believe that she is willing to listen and she may not have heard the details of any other analysis for Berkshire Gas’s situation from rate-payers.

Based on what I heard her main argument for increased natural capacity stems from her experience with Berkshire Gas.

ISO-NE

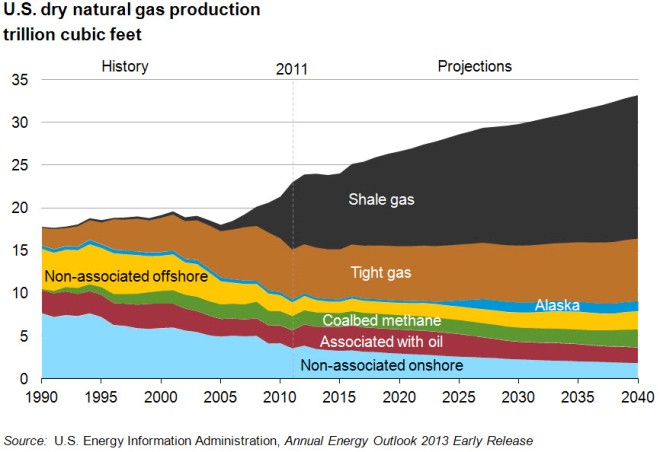

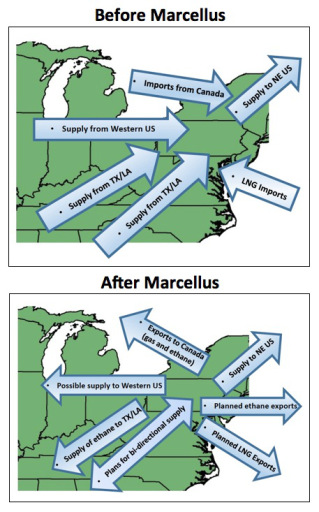

Anne George did the ISO-NE presentation alone and it was fascinating not for the facts presented but how it illuminated their thought process. The sum of her presentation was that low-cost shale gas made market rates cheaper and caused emissions to fall but since we don’t have enough of it we’ve seen price spikes, we’re going back to oil and emissions are rising.

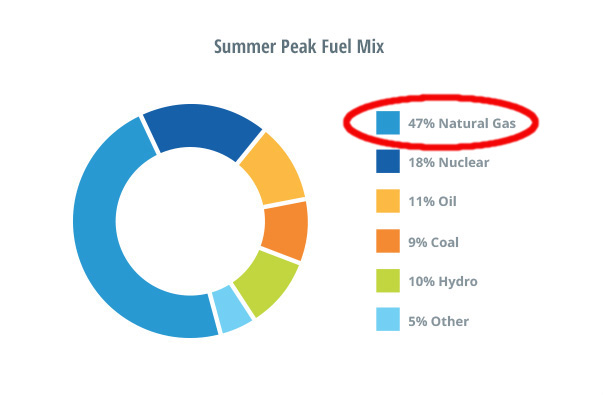

Senator Dowling asked her about the role of LNG in the fuel mix and at first she said we can’t rely on LNG because it may go away then she backed it down to LNG is subject to world demand so LNG prices are too volatile to rely on.

ISO-NE’s thinking LNG will go away is a fascinating slip; I imply that they either think shale gas is going to price it out of the market, our import terminals will be converted to export terminals or both. . .

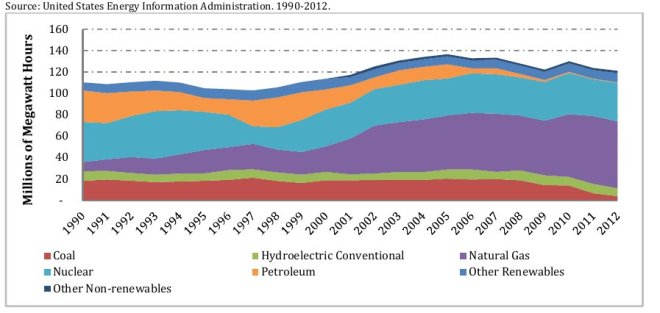

Senator Dowling also asked since we’re at more then 50% gas generation will adding more gas generation create an all-eggs-in-one-basket risk. Her response was initially defensive: if oil and coal go away what are we going to replace it with? Then she clarified that she believes if the new gas pipelines are big enough that will mitigate the risk however she can not say any more because ISO-NE is fuel-neutral.

Overall I got a can’t teach an old pony new tricks vibe from ISO-NE which was shown more clearly when she discussed renewables — they stated they have seen growth from wind and they are aware solar exists but have no insight into it (we don’t see solar in our control room).

This seems like a fundamental problem to me. The technical reason makes sense — solar connects to the utilities’ wires away from ISO-NE and they can’t control it. There are two pretty basic problems, though: 1) ISO-NE needs to react to solar (execute spinning dispatch) so it shocks me they have no insight into it and 2) if they don’t see solar it is never on their minds as a solution. If the only tool a person ever works with is a hammer everything is a nail.

National Grid

Marcy Reed did National Grid’s presentation and it was a little more grand-standing then others; for example, she stated they speak on behalf of all their customers (I can say, as a National Grid customer, they are not speaking on my behalf :)).

They stated we need all the proposed pipelines combined. Their argument is that if every generator were run at peak output simultaneously there would not be enough pipeline capacity unless we had all three. This is not the capacity test that anyone else uses; generators rarely run at peak output and there is always a subset down for maintenance, reserve, etc. The test for capacity is usually demand estimates.

National Grid’s capacity test doesn’t make sense to me; it seems like saying we need to double the number of gas stations because we can’t fill everyone’s gas tank simultaneously.

They also echoed ISO-NE’s stance on LNG.

Beyond that, it was another case of cognitive dissonance where they stated they support electric solar but then used the rest of the presentation to undermine every aspect of it. For example, Massachusetts has made more progress on solar then other states so we should scale back our incentives. Net-metering burdens customers without solar panels. It appears the only solar they like is if they run their own fixed solar plant or if customers have western-facing panels, National Grid pays them wholesale rates (no net-metering) and the customer pays for the grid. To be fair, western-facing panels is not a bad idea because it generates power during a high demand period (we should probably look at how to encourage that).

When asked if National Grid sees any benefit to solar the response was they’re studying it. When pressed harder about why they even bother saying they support solar National Grid responded we believe in climate change and solar has a role in alleviating it.

To me the utilities response to solar feels a lot like the RIAA’s response to digital on-line music when it emerged in the 90s. It was too big of a change for record companies to transition to on-line sales and instead of embracing it, they fought it and successfully delayed on-line sales for about a decade. They ultimately lost the entire market, though, by failing to change. Solar is certainly a growing pain for utilities but fighting it will only push customers to ultimately disconnect from the grid as panel prices continue to plummet and storage technology improves. If they fully embrace solar (even if it is painful) they have a chance at keeping their customers long-term. If they fight it just delays our overall progress toward renewables. . . .perhaps by a decade or two.

After solar National Grid was asked about hydroelectric and their response was we need gas because we need baseload which resulted in a awkward moment where the senator who asked the question informed them hydro is baseload. National Grid’s answer was then there is not enough hydro.

The last bizarre moment was when they were asked about how many customers they lost due to competitive supply (rate-payers ditching basic service) their response was they did not know.

What surprised me is that National Grid did not talk about their efficiency programs at all. Historically they had been very forward-thinking and aggressive. . . I wonder if that is still the case. . .

Eversource

Eversource’s stance on rates was similar to National Grid’s as well as their stance on solar (neuter net-metering, reduce incentives), so I won’t go into detail there.

They expect their Northern Pass project to bring in power from Hydro Quebec in 2018.

Lastly they were big supporters of NESCOE and Baker’s gas expansion plan.

Unitil

Unitil seemed to be the sad utility of the bunch; they’re small, they’re seeing very low growth and they expressed problems due to the economically challenged area they serve.

Like National Grid and Eversource they expressed dislike of solar as well as the need to increase diversity with natural gas (interesting word choice on their part).

They did give a solar anecdote that was illustrative, though. Basically they see their infrastructure as more of a hub-and-spoke system then a grid and when a customer generates more solar then the use they can overload a spoke. They question who should pay for that [spoke upgrade]. To me, this seems natural — they own the wires and the system so it is their responsibility (much like if a pole falls over it is their responsibility to pay for the replacement). PG&E had a number of lawsuits about this very question and the courts found it was their responsibility. Apparently, however, when generators overload a spoke they generally offer to pay for the wire upgrades to keep the power flowing and Unitil does not like that they don’t get that same deal from customers who generate power.

I’m starting to think that this is one of the core problems that all the utilities have with solar.

Municipal Electric Association

The municipal presentation was interesting in that, in sharp contrast to the investor-owned utilities, they have few problems to report. Apparently they have not had price spikes, their prices are lower then investor owned utilities, they have a great customer service record, all the legislators loved them and they’re at 20% renewable generation (better then all the other utilities). They take no stance on any of the issues the other utilities expressed.

Their only request is that they become a part of MassDOER’s Green Communities program which would require them to administer efficiency programs (which they traditionally have been exempt from). This seems like a win/win to me.

Beyond that I don’t believe they are required to net-meter solar but that was not brought up in neither their presentation nor the questions after.

Attorney General’s Ratepayer Division

I learned something new with this presentation — the attorney general’s office has a whole division dedicated to the energy markets including representing rate-payers as well as watching the markets themselves at ISO-NE and working with FERC to prosecute market manipulation. This was a great thing to learn about.